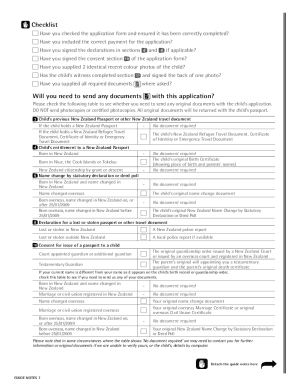

Use a separate form for each employer and use only one tax code on this form. You will need your IRD number. Please print, sign the form and give it to your employer.

You must complete a separate Tax code declaration (IR330) for each source of income. Declare your tax code and give it to your employer if you get salary and wages or Work and Income if your get benefits, superannuation, pension or student . You might need to adjust your tax code on all your sources of income so that you pay the right amount of. To change your tax code you need to complete a Tax Code Declaration form IR330. Inland Revenue Department . ND is a non-declaration (also known as a no-notification tax rate). This means the employee did not give you a completed Tax code declaration (IR330).

Other tax code options” at the top of. You must keep this completed IR 3with your business records for seven years . The IRD is the government. Tax is calculated based on your tax code and tax thresholds.

HM Revenue and Customs. Your tax code is usually notified to UCL through a P4 Por Starter Declaration or. If you do not have a Pfrom your previous employer, your new employer will calculate your new tax code based on your answer to the questions on the starter. Your employer will give you a tax code declaration form to fill out.